A Well-Paying Job Will Not Take You out of Poverty, But Your Financial Intelligence Will

The impact of the cashless economy in Nigeria coming at the hills of the 2023 elections jolted Nigerians from their…

The impact of the cashless economy in Nigeria coming at the hills of the 2023 elections jolted Nigerians from their financial complacency. Many, for the first time realized that their economic survival depended on how liquid or how much asset they owned that could easily be liquidated into cash. Questions about financial intelligence and income streams became hot topics.

To address this gap, a one-day special masterclass tagged Wealth Wisdom Class was organized by Ogheneyole Ugaga with Lady E Ejiro Umukoro co-facilitating. Key takeaways were shared with participants who were committed to raising their financial intelligence.

Ugaga clearly established busted one the misleading financial myth: a well-paying job does not automatically take you out of poverty.

The icebreaker followed a series of questions to the participants to think deeply on: “Have you ever wondered why, despite making so much, you can’t seem to follow your money or have cash on hard or even have evidence of Wealth or riches around you? You know you generate money and even earn more than your counterparts, yet you are not as comfortable when compared to those who seem to earn less than you do. You ask yourself why?”

The simple answer is: You lack financial intelligence. It is the same as financial illiteracy.

Developing high financial intelligence with some income will help you become financially successful to own run a successful business, career, a home, have your dream holidays, the best of education and other experiences you seek.

Say you’re a student for example and you know many students don’t like to write notes in class, a business opportunity has presented itself. You can charge students to have a copy of your well written notes in class and save those up in the bank without spending them. Imagine that you you charge N100 per page, and the total pages per each subject was 50, that’s N5,000 per page. If there were 7 subjects, that’s N35,000 for 7 subjects in one semester. If there were 3 semesters that’s N105,000! How many persons will be willing to gift you a hundred thousand for free? The goodness is, it costs you only a few pens and notebooks as your expenses. The time spent writing was cost effective in your quest for knowledge.

Other businesses you can earn from while in school is: digital marketing, project work ghost writing, research content, boutique-on-the-go, hair making or batbing salon, teaching financial intelligence, etc. You can look around you and ask: what are students needs they are willing to pay for? What is a scare or novel idea or product or service in other schools or states I can introduce to my school environment? Water bottle or sachet water business? Laundry? Agriculture cash food? Hostel shared spaces, manual work, cleaning business, recycling business, teaching other students for a fee, import and export, work space stations? Whatever money you make from these business, you goal is to discipline yourself to save 70% of you income after expenses have been deducted.

Perhaps you’re now out of school, and what you earn during the week days does not get you through school, what financially intelligent business or schemes should be into during the weekends or even during the week that serves as residual income? Perhaps you want to publish books, real estate network marketing, digital online businesses, direct food chain supplies, clothing of bale materials? Invest in buying gold? Special purpose vehicles? Building designs and materials? Think! Look around. Go out and do market research. Speak to other people. Hear what people are saying. Really listen and see the gaps and opportunities there is.

Now is the time to start investing in financial literacy books. Buy these books. They are investments and you can sell them later at a vintage price higher than the original price you bought them.

You can be smart and hard-working, but if you don’t have financial intelligence, you will always be back to square one.

Do this exercise now:

- Go to your bank and ask for your bank statement.

- Write down things you spend money on since Jan till date.

- Look at your expenses again. Are you spending your money well or wasting it?

- What is on that list of spending that you need tp stop spending on now?

- Are you spending too much on Data app, fuel, cable subscriptionaz, phone, food at eateries, watches, clothings, shoes, gift giving, tithes, transportantion, bad financial investment like POS where you money can be stolen by the sales person you hire? Or other types of ill-advised investment into network marketing, bitcoin, etc? What about investment on elections either for SUG, Guber, NASS or state Assemblies or similar elections lobbying?

Next exercise: ask yourself the following deep question and dig deep for the most honest answer to judge your finacial spending style. Are you spending this money because

- I CAN’T HELP IT!

- What would people say or think of me?

- I want to keep up appearances.

- I need to keep up with my circle of friends

- Shame to appear poor

- Jealousy and envy

- Pressure from family and religious members

- I am poor, so I can never be rich

- I come from a poor home, all my generations are poor people, so why will my case be different.

Remember: your mindset towards wealth creation will determine how far you can go, what knowledge you seek, you determination and consistency to lift yourself from where you are currently, to your network, and net worth.

Here are some quick saving tips:

- Rather than say you are poor, tell yourself you can not continue like this!

- Rather than run your generator the whole day or for several hours, set aside 3 hours to keep the

- fridge cool and freezer froze while you charge your phones and power banks. Time this period for all home work assignments and cooking, and watching the news, sports, or movies for you and your family.

- Buy 2 rechargeable lamps you can use throughout the night in place of buying fuel to run your generator.

- Reduce your cable subscription of N9,000 to a bouquet of N3,500 or free to air.

- Reduce spending on unnecessary clothes and reinvent how to use your current wardrobe. You don’t have to keep buying clothes every day or month. Cloths don’t need to be dumped every 6 months; 8 pieces spread 3 every six months. Or 2:3:3 for three quarters.

- Check the detergent you use or washing soaps to preserve the colour and texture of your clothing.

- Buy quality 3 suits, 2 pam slip-ons, 2 sneakers may just be all you need as a guy.

Become better at maintenance and reduce repeated spending.

Going Forward:

Do not make your financial decision to impress people to appear rich when you’re not actually one.

Watch your friends who force you to keep appearances. Become wealthy instead.

Do not subscribe to your ego. Subscribe to your need.

That you earn more does not mean you should increase your expenses.

Internal confidence does not depend on what you wear sometimes. When you get wealth all around you, you often do not feel like dressing to impress anyone at all.

The feel you get from building a house vs buying a 1 gold wristwatch is not the same. An N800k land can be resold for N2M in less than 3 months depending where the land is situated? Rethink your value system!

Do not have a wrong set of decision making when it comes to spending

The goal is to look good. Maintain them. Don’t buy randomly. The goal is to look good, not necessarily look expensive.

You can never be rich if you maintain an unhealthy cash flow.

To be rich, you have to earn more than you spend.

Do not spend cash on hand without first, allowing it to reflect in your cash flow. That is how you follow your money.

Have a mental picture of the financial position you want to be in one day, two weeks, 3 months from now. Review it daily and make your affirmations daily too. Make it a part of your consciousness. Write it down. Make a note.

Design an executive summary note on what you have, acquire and want to be in 1 to 10 years.

YOU have 0.1% of not achieving what you don’t write down. While you have 75% of achieving the ideas you write down. Write your ideas and dreams down now.

If you want to manifest your dream of owning a land, add a cost estimate to all you’ve written down and know the cumulative cost to everything. For example, you want to buy a land, find the cost around and project how you plan to save to buy the land.

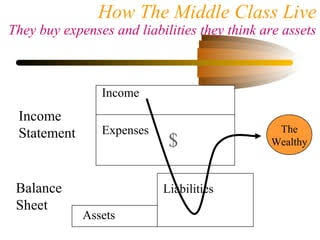

ASSETS AND LIABILITIES

What assets do you want to buy?

An Asset should give you more value later than when you first bought it or invested in it.

Any vision without SMART Goals is often not fully achieved. So start with the smaller objectives. If you want to build a house, start with buy the blocks in batches if you don’t have the full amount to buy in bulk. You can start with fencing the property up to 4 coaches, followed raising the building to DPC level, then next time to lintel, windows, and finally roofing levels. This can be done in blocks of weeks or months as money flows in.

Write down all you spend and what you spent it on.

Prioritse on assets that you have now and what you can spend later.

Stop paying for your inadequacies, too much comfort, ignorance, or stupidity.

Build more residual income: e.g books, training content, social media capital, etc.

Check your inflow.

Your financial decision should not be about how you feel but what you need and the value that spending or expense will bring in.

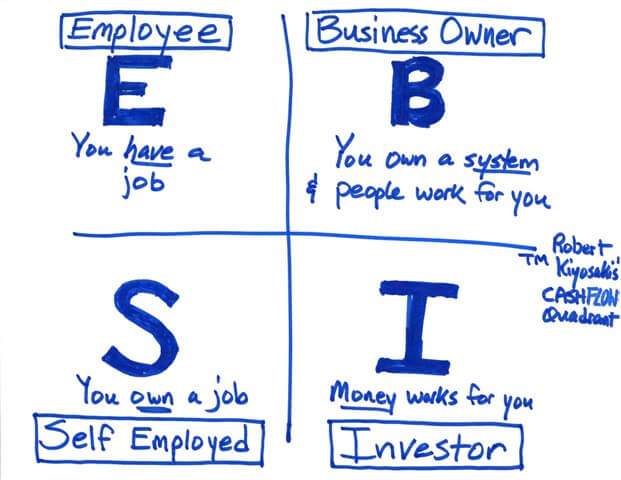

THE 4 INCOME/ASSET QUADRANT

Look at your assets and liability column, how will you rate your financial decision?

Examples of assets or investments include: land, any idea that brings you Income, cash gifts, donations, testimonials, what you can resell, etc.

Now is the time to leave the rat race when you apply the following reminders:

- You van never be wealthy without making a sound and objective financial decision

- Look at the overall impact you are about to make: Check you 4 Quadrants.

- A bad financial decision now may be good in 6 months instead. So why not make the decision then?

- What you cannot measure, you cannot control.

- Plan ahead your budget before spending.

- Know you Financial Runway

4 QUADRANT

| Income | Expenses |

| Asset | Liability |

To create more wealth, remember these tips:

- Delay gratification

- Look out for opportunities on distress sales

- Explore Affiliate marketing

- Consistently apply the Principle of Consistency – anything you concentrate on for 10,000 hours you’ll become good at it.

- Capitalise your social capital

- As in real estate, explore the alternative of other people’s money to set up a business idea.

- On a final note: Master your hunger to feed your needs, not your wants.

Comments